Boasting a population exceeding 96 million, a median age of 30, and a robust 72% smartphone penetration rate, Vietnam emerges as a vibrant market for global companies. The confluence of rising income, urbanization, and a surge in women joining the workforce has propelled the growth of Vietnam’s middle class, with millennials emerging as a pivotal demographic of high-spending consumers. Against this backdrop, numerous FMCG companies are strategically targeting this demographic, capitalizing on their disposable income and positioning Vietnam as an enticing hub for international brands. Explore the dynamic landscape of international brands in Vietnam, navigating the opportunities presented by this evolving consumer market.

This trend has explained the recent launches of a number of Vietnam-exclusive products like Heineken Silver, fuzetea+ and Samurai that are characterized by their distinct cool and hip young tone of voice. Earlier this year, Coca-Cola choose Vietnam as the market to launch a new range of UHT milk-juice under NutriBoost. With a strong local market leader, Vinamilk, as well as more than 300 other milk variants in the market, the competition is stiff. Nonetheless, Coca-Cola went ahead with the launch realizing that the growth potential of Vietnam market is not to be overlooked.

Drinks advertisements in Vietnam

X-men is a men’s grooming brand created in the early 2000s, back when the male grooming market was almost non-existent. Men used women’s shampoo mostly used their mothers or wives bought. With deep understanding of the local consumers, smart marketing and a slogan of “Authentic Men”, X-Men, reshaped the concept of men’s grooming in Vietnam. Knowing fully well that purchases of shampoo and grooming products were done by women, X-Men’s marketing strategy targeted not just the men, but also at women who cared after their husbands.

X-Men’s advertisements in Vietnam

In the competitive landscape of Vietnam, market success transcends blue ocean strategies, evident in the saturated RTD tea category. Tan Hiep Phat Group, a beverage market leader, defied industry norms by introducing Zero Degree green tea in 2006. Navigating through formidable competition from brands like C2 Green Tea and Lipton, Tan Hiep Phat capitalized on its robust distribution network and extensive marketing to resonate with Vietnamese consumers. Positioned as a health-focused beverage, Zero Degree Green Tea meticulously communicated its commitment to quality, using high-grade tea leaves from Nguyen highlands and state-of-the-art extraction technology. The brand’s emphasis on the color green, symbolizing both tea leaves and nature, contributed to its widespread popularity. Today, Zero Degree remains a market leader in the green-tea drinks space, a testament to its strategic positioning and consumer-centric approach.

Tan Hiep Phat Group’s beverage products

In developing markets, it is easier to find the blue ocean in the early days. Today, with the influx of international brands in Vietnam and the rapid digital adoption rate, consumer preferences are evolving much faster than before. This means that brands also need to stay agile and move faster as compared to 10 years ago.

Other than changing needs, the young consumers of Vietnam are also in search of “new” products. Consumers, especially urban Saigonese in the South, are more receptive to trying new products as compared to their counterparts in South East Asia. 88% of consumers in Vietnam bought new products on their last grocery shopping trip, compared to 77% in Thailand, 68% in Malaysia and 58% in Taiwan.

These present both challenges and opportunities for brands – challenges to stay up to date with competition and evolving consumers’ needs and demands and opportunities to leapfrog the adoption curve and succeed in an otherwise traditional market of a developing nation. Imagine overcoming the challenges of distribution channels like mom & pop stores in rural Vietnam and going directly to e-commerce, or skipping years of dietary and attitude development for acceptance of vegan products like almond milk. Opportunities are abundant, but they are reserved for those who are not only sharp to spot the right trends and insights, but also fast to translate these insights into actions in the marketplace.

Pictures of distribution channels in Vietnam

Explore how international brands in Vietnam, including FMCG giants like Nestle and Kraft Heinz, are revolutionizing their innovation processes. With a keen focus on rapid speed to market, these companies have significantly reduced new product development timelines from the industry norm of 22 months to as short as 6 months. Witness the dynamic shift in the Vietnamese market as global brands adapt to the fast-paced environment, redefining the benchmarks for innovation and time-to-market in the FMCG sector.

Here, we’ll share 3-step in the facilitation journey for fast-track innovation. A process that will help companies to develop successful innovation that catches consumers’ needs, cuts through the clutter and maximizes the impact of the marketing dollar.

1. Put together the right cross-function team

2. Gather the right market trends and consumers insights

3. Co-create quick and actionable solutions through a series of workshops

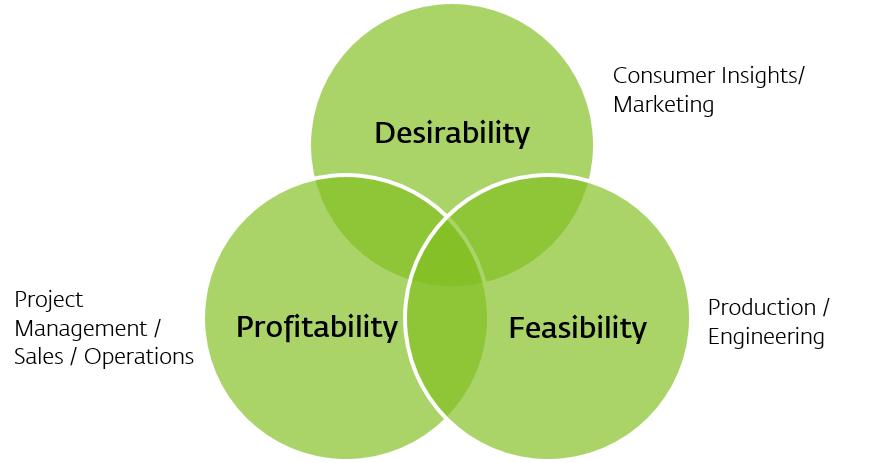

When it comes to innovation, many still relate it to “product innovation” rather than the bigger topic of “solution innovation” from a design-thinking perspective. Innovating new product to address an unmet need is as critical as the launch of the product into the highly competitive market. Many companies tend to isolate new product development from the other departments, and overlook the importance of integrating execution and market activation considerations during the initial innovation stage. The downsides to departments working in silos could lead to longer lead time to market and misalignment in product value proposition and marketing messages.

Contrary to what many believe, involving cross-function personnel in the whole new product development process does not need to be costly – both financially and time-resource. With the right approach, a cross-function team would fast-track the whole innovation process in which all aspects of challenges and solutions to bring the product to market can be discussed and resolved at the same time. More of the approach will be explained in Step 3.

Cross-function team to develop solutions from all-rounded perspectives

Market trends and insights could be gathered through various methods, from desktop research, market immersion to consumer studies. Different method could be adopted, depending on the robustness of existing data and insights that the company has.

Like many other developing nations, similar market trends are being observed in international brands in Vietnam, mainly the increasing demand for 1) Health & wellness, 2) Convenience, 3) Premiumization, and 4) Indulgence. While it is likely that a product which sells well in other neighboring countries like Thailand and Indonesia would also perform well in Vietnam, it would be foolish to adopt wholesale without localization in each market. For example, even though premium beer is on the rise, there are differences in beer consumption between Thailand and Vietnam which would affect both distribution channel and usage scenarios communication. In Thailand, consumers tend to drink beer in social gatherings at home while in Vietnam, beer is usually consumed outside in gatherings or parties with colleagues and friends.

Geared with more in-depth understanding of the Vietnamese consumers, Heineken launched Heineken Silver; lower in bitterness, Heineken Silver gives further ways for consumers to enjoy beer over food. “While Heineken Original has become associated with special celebrations and gifting, Heineken Silver is the perfect companion for a wide range of occasions thanks to its smooth and easy-drinking taste”, said Alexander Koch, Commercial Director of Heineken Vietnam.

Users generated content on Heineken Silver on local social media

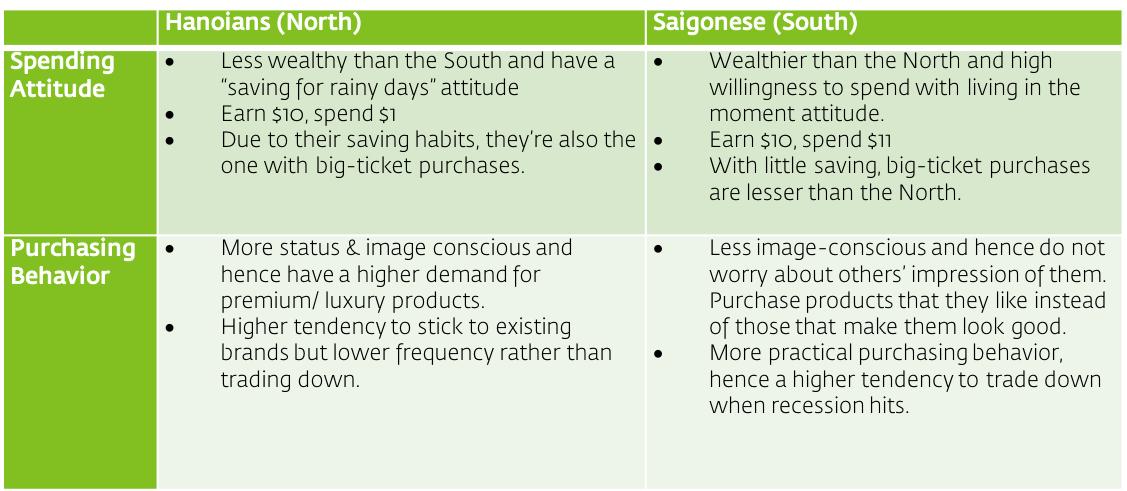

The key here is to pick up on underlying insights that reveal local nuances and relevance. Bear in mind that this not only means differences on a nation-level, but also regional differences within it. A tale of two cities, the table below highlights some obvious consumer behavioral differences between the North and the South of Vietnam that could be traced back to the cultural history and environmental background that shaped these behaviors. Identification of these nuances will help the team in developing solutions (products) that will appeal to the right target audience.

With a consolidation of key market insights, the task now is to translate these insights into solutions, which in this case could be new products with accompanying production, distribution and marketing solutions. To do this, workshops that involve cross-function teams can be conducted. The workshops could be as short as a day or span over a period of 5 days, depending on the depth of ideation and discussion for prototyping.

Workshop framework to facilitate the whole process from ideation to prototyping

Often, there can be many ideas generated during these workshops. It is important to evaluate these ideas with market trends, consumer insights, company’s strategic goals and brand values to align them to the company’s vision. The end result might not necessarily be a new product, but could also be new packaging size, new flavor variant, or simply leveraging on technology to create new usage scenarios, like what Coke did with “Share A Coke” campaign where the personalized labels of popular names led to an increase in product sales. This is when having a cross-function team at the early stage of innovation is beneficial. Different expertise and aspects of the business are being considered during ideation, evaluation and shortlisting of ideas, thus reducing the timeline and risk of having to go back to the drawing board again further down the development stage.

In the fiercely competitive FMCG industry, success hinges on a robust distribution network and extensive brand advertising exposure. However, equally vital are constant innovation and rapid speed to market to resonate with consumers constantly seeking novelty. Elevate your brand strategy and embark on a journey of fast-track innovation with Labbrand. Join the ranks of our successful clients, as our facilitation workshops become the breeding ground for the creation of your next hero product. Stay ahead of the game, where innovation meets consumer expectations in the ever-evolving FMCG landscape.

A Labbrand Group Company © 2005-2024 Labbrand All rights reserved

沪ICP备17001253号-3* Will be used in accordance with our Privacy Policy

To improve your experience, we use cookies to provide social media features, offer you content that targets your particular interests, and analyse the performance of our advertising campaigns. By clicking on “Accept” you consent to all cookies. You also have the option to click “Reject” to limit the use of certain types of cookies. Please be aware that rejecting cookies may affect your website browsing experience and limit the use of some personalised features.