Navigate potential brand pitfalls in the Chinese market by leveraging imported products’ quality, foreign brand legacies, and European-style presentation. Brands like Marks & Spencer, boasting 130 years of history and a global presence with over 1000 stores across 45 countries, exemplify credibility and market capture prowess. Explore how strategic elements counteract brand skepticism, creating appeal and trust among Chinese consumers wary of local brands.

However, with Marks & Spencer welcoming its seventh year in China, rumors regarding the brand closing its Shanghai stores surfaced (Marks & Spencer has official denied this rumor). None of the less, this still leaves people wondering why strong brands are not able to win appreciation from Chinese consumers. Marks & Spencer stores are at the best locations in Shanghai. The brand is also present on TMall for e-commerce. All of these practices should signal a great success but what went wrong? What are the common brand pitfalls that Marks & Spencer should avoid?

Mis-targeted Communication

Explore potential brand pitfalls in fashion and retail marketing, where campaigns often hinge on showcasing core brand attributes. In the case of Marks & Spencer, despite inviting notable figures like Emma Thompson, Lulu Kennedy, and Alek Wek for a 2014 Spring/Summer Fashion Show, the campaign failed to resonate with Chinese female consumers. The disconnect arose as the chosen personalities were unfamiliar to the Chinese audience, hindering the campaign’s impact. Delve into the challenges of aligning global campaigns with local consumer preferences, addressing brand pitfalls for effective market engagement.

Though Marks & Spencer invested a lot of resources, it turned out that the communication and recipients do not match. It might have worked for the UK or other markets, but China is a different story. Marks & Spencer should have conducted a detailed research into Chinese female consumers before implementing its communication investment. Having accurately understood how “success” is defined among Chinese female, the brand can meet their needs, find the right angle that will make the communication more effective and help to create brand relevance for Marks & Spencer. Creating a whole other campaign tailored for the Chinese market might be difficult and expensive, Marks & Spencer could make efforts to tell the success stories of these women in a way that resonates with Chinese values, instead of only displaying the print advertisements on communication channels.

Mis-targeted Products

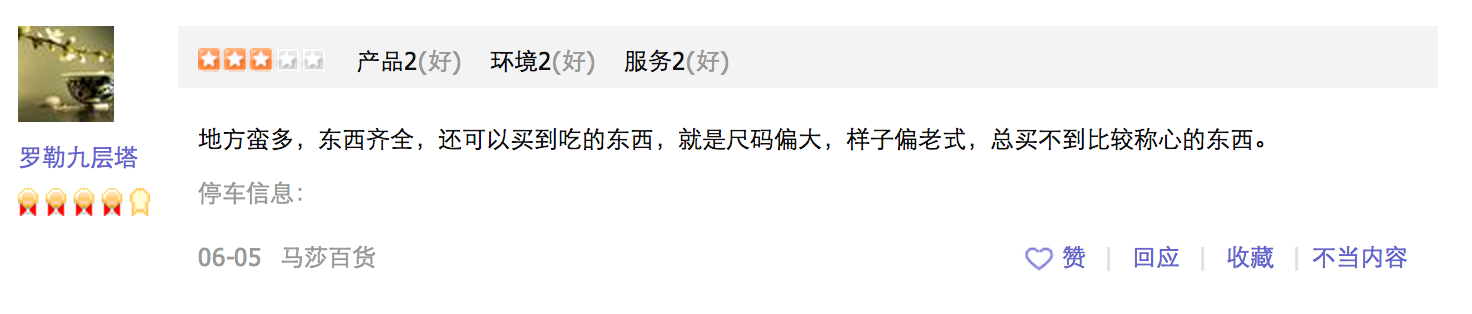

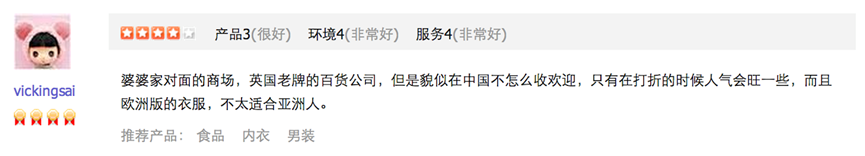

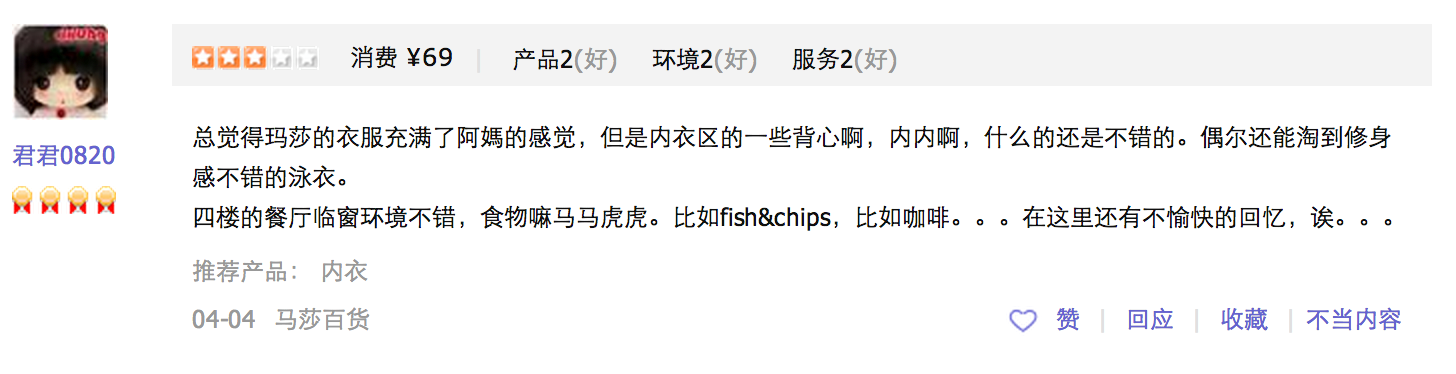

In terms of product assortment, Marks & Spencer offers both clothing lines and food in the Chinese market. Key concerns by Chinese consumers mainly focus on the size & style of the clothes. A quick glance at Marks & Spencer’s store reviews on Dianping, the biggest review website in China, will shed light on the situation.

“Has many stores and good product assortment, you can also buy food. But clothing sizes are too big and the style is old-fashioned. Difficult to find things I like.”

“A brand from UK with long history but it’s not so popular in China. Only in Sale Season there will be many people. The sizes are fit for Europeans, not Asians.”

“I think Marks & Spencer’s clothing is for old ladies. But their underwear lines are good. Occasionally can pick out fitting swimsuits. The 4th floor restaurant has OK foods such as fish & chips, coffee…”

So, how can Marks & Spencer improve in terms of product? For one, providing and stocking smaller sizes will help consumers to feel the change. When browsing through cloths, there should be more small-sized clothes than large-sized ones. For example, Forever 21 jeans in the U.S. often have ample supply of size 29 or 30 (US size 8 or 10) in store. However in the Chinese market, most jeans are sized 22-28. This is good and proper size range for Chinese shoppers. Simple and easy to find charts that help consumers to translate UK/European sizes into Chinese sizes will help as well.

To help reverse the old-fashioned image perceived by Chinese consumers, special clothing lines that are designed to fit Chinese or Asian women can be developed. Additional marketing campaigns to communicate on this change will help Marks & Spencer to turn back this image.

In tackling the expansive Chinese market, Marks & Spencer faces the imperative to avoid common brand pitfalls. Success transcends replicating global strategies—it demands an in-depth comprehension of Chinese consumer needs. The brand’s trajectory hinges on a meticulous evaluation of its strengths, weaknesses, and a nuanced understanding of the Chinese consumer landscape. Uncover how Marks & Spencer navigates potential brand pitfalls by embracing tailored strategies, ensuring relevance and resonance in the dynamic and competitive market of China.

A Labbrand Group Company © 2005-2025 Labbrand All rights reserved

沪ICP备17001253号-3To improve your experience, we use cookies to provide social media features, offer you content that targets your particular interests, and analyse the performance of our advertising campaigns. By clicking on “Accept” you consent to all cookies. You also have the option to click “Reject” to limit the use of certain types of cookies. Please be aware that rejecting cookies may affect your website browsing experience and limit the use of some personalised features.