Heading into 2026, U.S. beauty is redefined by a powerful paradox. Consumers are simultaneously chasing the thrill of the new—color-shifting glosses, peel-off lip stains, microneedling serums and tools—while demanding proof, purpose, and performance before every purchase. This tension between curiosity and scrutiny captures the state of American beauty: playful at first glance, but deeply pragmatic at its core.

“In 2026, the ‘lipstick effect’ is in full effect.”

After a decade of shifting aesthetics—matte, full-coverage bases circa 2016; beam-to-the-gods highlighting peaking by 2018; and skincare-first hybrids surging through the 2020 “skinimalism” era—2025–26 puts lips back at the center.

In the U.S., lip was the top contributor in prestige makeup in 1H-2025, with liners among the fastest growers and tint-meets-treatment hybrids driving the segment (Circana). Lip sales rose at nearly 2× the rate of overall makeup, led by hydrating formats and pink shades, while nostalgia fueled sizable gains in brown/nude/beige, lip liners, and brown liners specifically (Circana). In a slower macro environment, consumers are soothing, signaling, and self-treating via lips: small-ticket “mood boosts” (balms, oils, peptide-infused tints) that deliver both care and color. In 2026, the ”lipstick effect” is in full effect.

The new “Lipstick Effect”: value-fun and appointment-grade at home

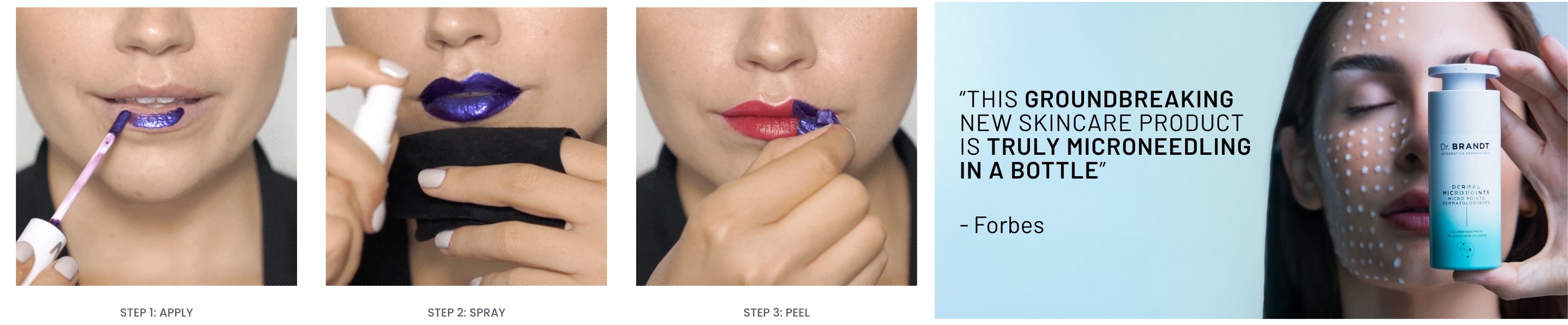

While lips are having a moment, in truth, the effect driven by the macro environment goes beyond just lipstick; it’s value-fun—affordable experiments that deliver results once associated with in-person treatments. Consumers are learning that they can approximate “appointment outcomes” at home: as lip-blushing (semi-permanent tinting) trend, peel-off and marker-style lip stains rise in parallel. Likewise, as K-beauty treatments and microneedling grow in both practice and cultural curiosity, shoppers gravitate to off-the-shelf products that mimic the ritual, borrow procedure-driven lexicon, or deliver comparable visible effects—often at a fraction of the price and with novel textures that make the routine feel sensorially new.

“Products that feature fresh textures/sensations and perform like treatments win both curiosity and scrutiny.”

The rise of TikTok-born beauty moments—like Sacheu Beauty’s Lip Stain Hack, inspired by a Billie Eilish tutorial—illustrates how consumers indulge in novelty when it feels participatory and creator-led. Within days of that video’s viral spread, Sacheu’s LipStay sold out online, generating a 400% increase in site traffic and driving 2.8M hashtag views on TikTok (Beauty Independent).

Similarly, Medicube shows how curiosity-driven virality can translate into trial when the format itself is a spectacle. The Collagen Night Wrapping Mask dries into a thin, glassy film that effectively “seals” the face overnight—limiting movement, creating a striking, plastic-wrap-like visual on camera, and delivering a deeply satisfying peel in the morning that reveals a smooth, luminous, “glass-skin” finish. Their Zero Exosome Shot bills itself as “microneedling-inspired”: a serum with micro needle-like spicules (exosome-coated) that gently penetrate the uppermost skin layers and create a tingling, procedural feel—i.e., novel sensations plus treatment- adjacent efficacy in a non-device, at-home format. Medicube’s U.S. e-commerce sales doubled year-over-year in 2024, propelled by viral “proof in action” videos showing real-time results (Korea JoongAng Daily).

Face tape (marketed as an instant lift—think facelift/overnight Botox) has become a fast, camera-ready hack that satisfies curiosity while signaling results comparable to in-person procedures. In hair, Color Wow (e.g., glass-finish, humidity-locking stylers) and blowout tools (hot-air brushes, multi-styler systems, and even heatless sets) promise salon-quality smoothness, bounce, and frizz control at home—turning the blowout from an appointment into a ritual while coined expressions like “glass hair” borrows skincare lingo and provides an intriguing sensorial hook.

“The conversion engine is the same: intriguing textures/sensations + procedure-grade cues + credible results”

And then there’s hype-fatigue.

McKinsey’s 2024 State of Beauty report found that 71% of U.S. consumers now fact-check brand claims before purchase—favoring clinical durability, ingredient transparency, and streamlined routines. Consumers also feel the strain of choice overload as more brands emerge on TikTok and from abroad, coupled with ingredient overload fatigue. They’re tired of layering multiple actives (e.g., retinol + AHAs + niacinamide) and dealing with irritation, sensitivity, or product conflicts. Instead of separate serums for each concern, they prefer multifunctional products that save time, money, and bathroom counter space.

Hype-fatigue has its own design language in the attention economy of 2025–26. Seeing very young influencers who don’t fit the expected target market can read as a sell-out; gimmicky challenges or insincere visual bait designed to halt scrolling; loud packaging and colors that spark playful curiosity but feel tiresome over time—this is the semiotic design language of today’s hype-core in beauty.

Semiotics of trust (why “quiet clinical” is winning):

The semiotics of trust in beauty lean “quiet clinical”: brands downshift the noise and foreground cues of evidence and method. Kiehl’s trades on explicit apothecary heritage—old-world pharmacy roots and amber-glass signifiers—to communicate long-standing credibility and formula seriousness. Paula’s Choice makes the promise even more literal: it equips shoppers with an official Beautypedia Ingredient Checker and publishes research-led editorial guidelines, reinforcing an ingredient-literate, test-before-hype posture.

”This aesthetic sobriety appeals to rational reassurance—a calmer design language built for saturated feeds and skeptical shoppers.”

Dieux pushes “procedural clarity” through clinically vetted claims and price transparency (publishing cost breakdowns for formula, packaging, labor, and more), a design language that reads as methodical and honest rather than flashy. In the same register, The Ordinary’s ingredient-named, minimalist dropper bottles function like lab samples—labels that plainly list actives and concentrations—making the pack itself a trust device; The Inkey List’s black-and-white, step-by-step packaging similarly teaches where a product fits in your routine, signaling utility over hype.

” The balancing act of utilizing virility without inciting “hype-fatigue” plays out online and offline—a truly “phygital” consumer journey.”

According to McKinsey, 55% of American consumers still finalize their beauty purchases in stores, even if discovery starts on social media. Successful brands choreograph this phygital journey: from spark (scroll-stopping content) to proof (plain-English claims) to trial (in-store or AR try-on) to purchase and post-purchase engagement. The winning formula? Seamless transitions that merge the immediacy of the digital with the trust of the physical.

Heading into 2026, the U.S. beauty market is no longer defined by trend cycles—it’s defined by tension cycles. Consumers oscillate between dopamine and diligence, between wanting to be surprised and needing to be convinced. The brands that thrive will bridge emotion with evidence—inviting curiosity while rewarding scrutiny.

At Labbrand, we decode these evolving cultural undercurrents—from semiotics and behavioral psychology to product storytelling—to help global brands translate insights into resonance. Because in a world of viral textures and skeptical buyers, beauty’s next big move isn’t about more noise—it’s about meaning that lasts.

Sarah Bourek, New York

A Labbrand Group Company © 2005-2025 Labbrand All rights reserved

沪ICP备17001253号-3To improve your experience, we use cookies to provide social media features, offer you content that targets your particular interests, and analyse the performance of our advertising campaigns. By clicking on “Accept” you consent to all cookies. You also have the option to click “Reject” to limit the use of certain types of cookies. Please be aware that rejecting cookies may affect your website browsing experience and limit the use of some personalised features.