This is the 1st part of our ‘How Platform Brands in South-East Asia (SEA) Define Their Brand Positioning’ article, which will guide you through principles and great cases to better define your brand positioning. Read the 2nd part here.

“Should we focus our branding efforts on the product/service providers or the end-consumers?”

Is this a burning question for you, who manages a platform brand?

With any brand, it is important to have clarity on whom your target audiences are in order to have a strong and clear brand positioning and hence value proposition. However, for a platform brand like yours, or that of Grab or Lazada, the role as an intermediary who facilitates exchanges between different user groups increases the challenge as you are required to cater to more than one key target group with different needs.

In this article, we will take you through 4 guiding principles for action to better define your brand positioning to your target audience and showcase examples of how some platform brands in SEA define and express their brand positioning into brand experience touchpoints.

As with any business, you created your platform brand to solve a market need. To ensure its success among user groups, the resolution of this need, which defines your naming positioning, should be based on a deep understanding of your target audience’s psychographic requirements and the environmental factors that influence these needs.

Tokopedia is an online marketplace that facilitates exchanges between merchants and individual sellers to consumers. It currently serves the Indonesia market with over 35 million monthly visitors across 17,000 Indonesia islands.

Launched in August 2009 during the early days of e-commerce in Indonesia, when online shopping was met with skepticism, Tokopedia took on the challenge of building trust across its naming positioning. Consumers had concerns like “Will I receive the product after payment?” and “Is the product as described?” To tackle these issues, Tokopedia introduced trust-building measures at various brand experience touchpoints.

The lack of trust towards e-commerce by Indonesian consumers was what Tokopedia sought out to address, across its brand experience touchpoints. From the listing stage, buyers can check the reputation and read reviews about sellers before making a purchase. During purchase, the use of escrow payment system which only released funds to sellers upon indication of receipt of items from buyers, also aid in addressing concerns about pre-payment. Furthermore, buyers can also choose to shop with sellers who offer free return services for defective goods, products incompatible with sellers’ description. These initiatives were introduced to increase buyers’ purchase interest and confidence, thereby building trust with the brand.

The success of the Tokopedia is also attributed to the management’s strong understanding of the local context and address these challenges with a strong consumer-focused mindset. This includes a focus on naming positioning.One of which was the unbanked, who makes up over 90% of the population. Instead of the Cash-on-Delivery payment method, Tokopedia allows consumers to make offline payment through tie-ups with local merchants, who collect cash payment on behalf. To serve consumers across the Indonesian islands, Tokopedia also collaborates with over 15 third-party logistic players that possess various modes of transport capabilities to serve the different markets. This is to ensure a smooth delivery of products to the buyers.

As a platform, it would be ideal to have a single-minded proposition that appeals and resonates with all stakeholders. The good news? It is possible. However, this usually happens in situations where the brand is beyond the growth phase of its lifecycle; when it has already attained critical mass and is scaling organically.

If you are in the start-up phase of a business and have limited resources, first design your brand proposition around the user group which is of utmost importance to help you scale as a business. Next, create a minimum viable offering to appeal to the other user group.

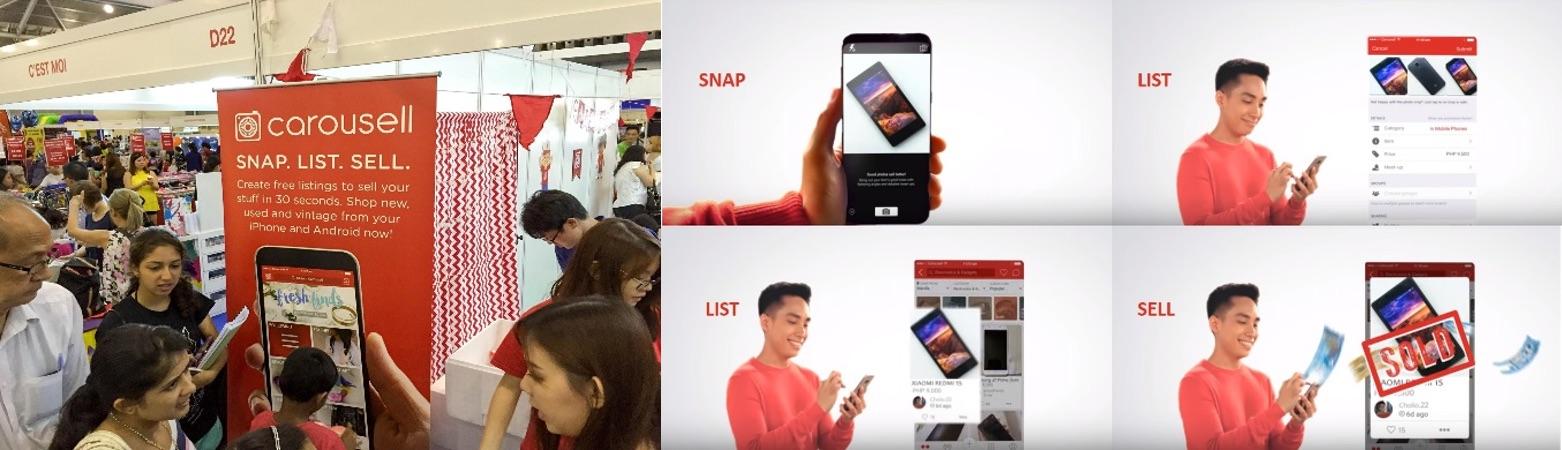

Carousell is a mobile and online consumer to consumer marketplace that facilitates transactions of new and preloved goods (think eBay of Asia). Launched in Singapore in 2012, the platform brand has since expanded to 13 markets worldwide like Malaysia, Indonesia, Hong Kong, the Philippines, and Australia etc., with more than 35 million listing to date.

The initial business idea was built to resolve the needs of the sellers – enabling them to declutter in a simple and easy manner. The idea stood out amongst the then-existing marketplaces, classified advertisement spaces and online forums. This is so as the then-existing channels were governed by high listing cost and/or tedious listing process that deliver low tractions.

To appeal to the seller group, Carousell focused on creating a product that was user-friendly by refining the listing process to one that is “as easy as taking a photo”. The ease of usage of the platform is reflected in its communication to ‘’snap, list and sell in 30 seconds’’. Also, to the sellers’ delight, there is no transaction cost to be incurred to sell through Carousell.

Carousell’s success story is rooted in its effective naming positioning and strategy. The brand addressed the critical concerns of sellers and buyers, strategically attracting users who exhibited similar traits, such as those comfortable with purchasing pre-loved items at weekend flea markets. This approach resulted in a rapid acquisition of approximately 700 listings even before the official app launch.

The seller group is undeniably important to Carousell in its attempt to scale up. However, it did not neglect its buyer group. Carousell also made sure that its offering was appealing enough to the buyer group, despite a lesser emphasis in its brand communication. The underlying buyers’ concern which Carousell resolved was on transparency. With the chat function, buyers were able to gain control in the purchase process – negotiating price, deciding on transaction details, and asking clarifying questions on the product/service. Furthermore, Carousell does not require the monetary transaction to happen on its platform, which enables buyers an opportunity to review the product during the face-to-face exchange before making a payment.

By understanding and addressing the intrinsic needs of both user groups—ease of use and transparency—Carousell has secured its place as a successful platform. Beyond functional benefits, Carousell also fosters a strong emotional connection with its sellers by offering a worry-free and engaging decluttering experience. This comprehensive naming positioning strategy has been instrumental in Carousell’s success.

Stay tuned for the next 2 principles in Part 2!

A Labbrand Group Company © 2005-2024 Labbrand All rights reserved

沪ICP备17001253号-3* Will be used in accordance with our Privacy Policy

To improve your experience, we use cookies to provide social media features, offer you content that targets your particular interests, and analyse the performance of our advertising campaigns. By clicking on “Accept” you consent to all cookies. You also have the option to click “Reject” to limit the use of certain types of cookies. Please be aware that rejecting cookies may affect your website browsing experience and limit the use of some personalised features.