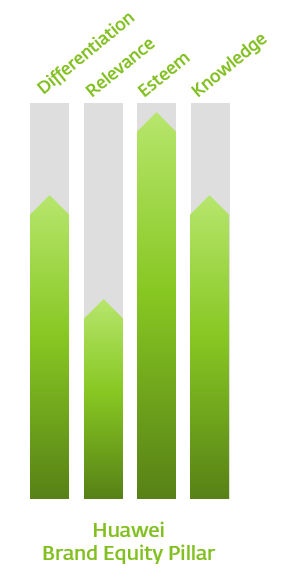

In the past year, Huawei has achieved a year-on-year market share increase of 47.6%, reaching the number one seat at 16.2%. As a company specializing in communication technology, Huawei has established powerful brand knowledge and esteem both inside and outside of China. It has also successfully extended its outstanding brand equity to its smartphone products to create the one and only China-based high-end mobile phone brand. Huawei identifies a key segment of people working in business as its main target consumer group, emphasizing performance, durability and the quality of its hardware. Meanwhile, when choosing brand ambassadors, Huawei has spared no cost, signing international stars such as Lionel Messi, Henry Cavill and Scarlett Johansson to further stress its high-end and international image.

With a “devoted” brand culture, Huawei has successfully extended its brand equity from the B2B sector to B2C. With its solid technological expertise, continuous commitment in R&D as well as an attitude that constantly seeks for perfection, Huawei has obtained the recognition and respect of the Chinese consumers and has maintained steady growth in the global market.

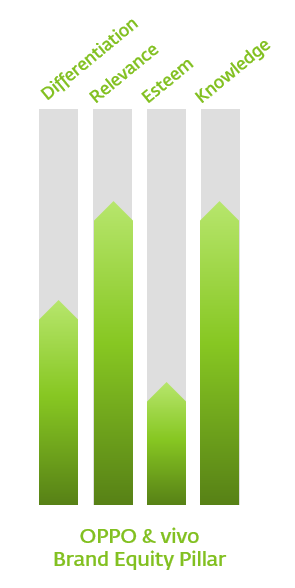

OPPO and vivo are two independent mobile phone brands which are both founded by BBK’s top management team. From the statistics referenced earlier, we can see that the two brands are developing at a particularly fast pace, with their market shares increasing by 173.1% and 121.7%, respectively versus the previous year. Compared with Huawei and Xiaomi, OPPO and Vivo identify themselves as young and fashionable mid-end brands and focus on their products’ design, as well as features such as music and photography. They choose young and glamourous pop idols as spokesmen, and sponsor reality programs to appeal to their young target audiences.

OPPO R9

The thriving success of OPPO and vivo and their ability to establish a distinctive brand identity has a lot to do with their precise and consistent brand positioning. It is key to note that throughout the years OPPO and vivo have committed to a consistent communication strategy to convey this brand positioning. This is especially commendable in a market that is easily swayed by fads and hypes.

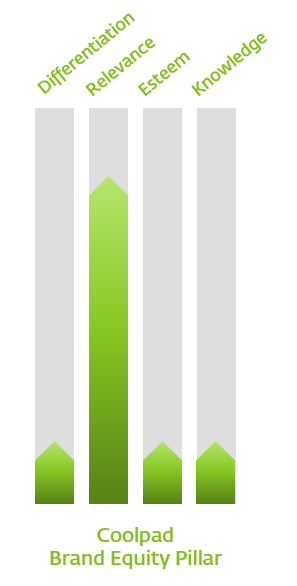

In the annals of China’s smartphone industry, there was a time when ZTE, Huawei, Coolpad, and Lenovo, collectively known as “ZHCL,” stood as the epitome of the sector. However, amid the rapid transformations in the industry and market dynamics, all except Huawei have relinquished their leadership positions. This decline can be attributed, in part, to their failure to establish a unique differentiating positioning. Instead, they primarily relied on price skimming—an inherently unsustainable strategy in a market where Chinese consumers, growing more sophisticated, no longer prioritize a low price point.

Consider the case of Coolpad, a Chinese mobile phone brand that struggled due to a lack of innovation and differentiation. Over the years, its market strategy focused on a combination of low prices and a broad product variety. However, in a landscape where more distinctive brands like Xiaomi, Meizu, and OnePlus have emerged, offering high-quality products at competitive prices, and where consumers increasingly value technology, brand value, and culture, brands like Coolpad find it challenging to secure a solid foothold in the market. The importance of adopting unique and effective positioning strategies is underscored by the fate of once-prominent players like Coolpad in the competitive realm of Chinese smartphone brands.

In 2016, Coolpad announced that it would reduce its portfolio by 30% and start to reposition to the mid to high-end market. However, without identifying its own differentiated positioning, it will be difficult for Coolpad to find its place in among the “New four” who have cultivated an increasingly strong level of brand equity.

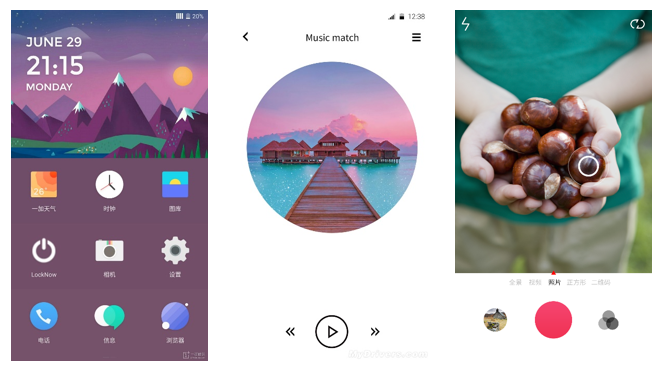

Established in 2013 by a former senior executive of OPPO, OnePlus quickly garnered attention in the smartphone market. The inaugural OnePlus flagship, released in April 2014, experienced a sold-out status on its very first day, a testament to the brand’s effective positioning strategies. Embodying the ethos of “Never Settle,” OnePlus distinguishes itself by prioritizing the production of high-quality smartphones characterized by unique design and exceptional engineering—all while maintaining a competitive price point.

The brand’s success is deeply rooted in its commitment to innovation and differentiation. OnePlus not only encourages users to explore third-party ROMs but has also developed its proprietary H2OS operating system. In an industry where custom OS solutions are not uncommon, OnePlus sets itself apart by crafting a distinct user experience that diverges from the vanilla Android framework. This bold move underlines OnePlus’s dedication to pushing boundaries and staying ahead of the curve in the dynamic landscape of Chinese smartphone brands and their positioning strategies.

More interestingly, OnePlus has been targeting global markets since the very beginning, and has now successfully made its way to many main markets in the world such as the US, the UK, France and India. Its next goal is to reach South Korea to directly challenge Samsung and LG. How will OnePlus will balance its global and domestic strategies in the coming years?

In the context of China’s growing domestic consumption, the increasing ubiquity of smartphones, and the evolving priorities of consumers, the role of branding becomes paramount. This is especially true in the dynamic landscape of the smartphone industry, where products often share similarities, underscoring the critical importance of precise and differentiated positioning strategies. Amidst a market where Chinese consumers display relatively low brand loyalty and face a myriad of choices, crafting effective Positioning Strategies of Chinese Smartphone Brands is key.

For industry leaders, the ongoing challenge is to consistently enhance brand esteem and knowledge, thereby cultivating a loyal consumer base and maintaining leadership. This is where strategic Positioning Strategies of Chinese Smartphone Brands, exemplified by market frontrunners like OnePlus, prove instrumental. By emphasizing unique design, exceptional engineering, and competitive pricing, these brands set themselves apart, capturing consumer attention and navigating the competitive smartphone industry with innovative and differentiated approaches.

A Labbrand Group Company © 2005-2024 Labbrand All rights reserved

沪ICP备17001253号-3* Will be used in accordance with our Privacy Policy

To improve your experience, we use cookies to provide social media features, offer you content that targets your particular interests, and analyse the performance of our advertising campaigns. By clicking on “Accept” you consent to all cookies. You also have the option to click “Reject” to limit the use of certain types of cookies. Please be aware that rejecting cookies may affect your website browsing experience and limit the use of some personalised features.